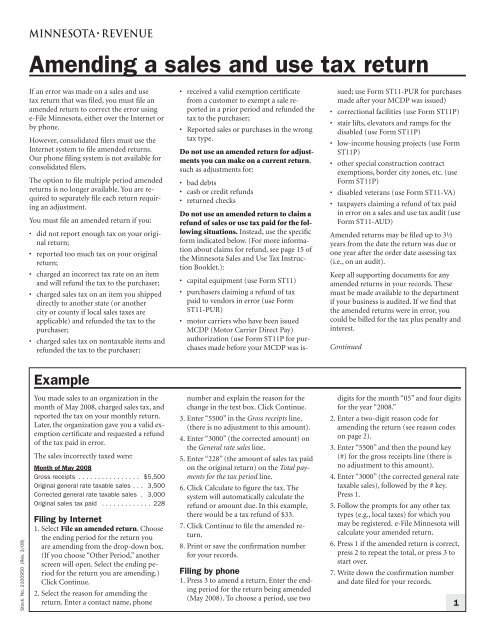

Amending a sales and use tax return If an error was made on a sales and use tax return that was filed, you must file an amended return to correct the error using e‐File Minnesota, either over the Internet or by phone. However, consolidated filers must use the Internet system to file amended returns. Our phone filing system is not available for consolidated filers. The option to file multiple period amended returns is no longer available. You are required to separately file each return requiring an adjustment. You must file an amended return if you: • did not report enough tax on your original return; • reported too much tax on your original return; • charged an incorrect tax rate on an item and will refund the tax to the purchaser; • charged sales tax on an item you shipped directly to another state (or another city or county if local sales taxes are applicable) and refunded the tax to the purchaser; • charged sales tax on nontaxable items and refunded the tax to the purchaser; • received a valid exemption certificate from a customer to exempt a sale reported in a prior period and refunded the tax to the purchaser; • Reported sales or purchases in the wrong tax type. Do not use an amended return for adjustments you can make on a current return, such as adjustments for: • bad debts • cash or credit refunds • returned checks Do not use an amended return to claim a refund of sales or use tax paid for the following situations. Instead, use the specific form indicated below. (For more information about claims for refund, see page 15 of the Minnesota Sales and Use Tax Instruction Booklet.): • capital equipment (use Form ST11) • purchasers claiming a refund of tax paid to vendors in error (use Form ST11‐PUR) • motor carriers who have been issued MCDP (Motor Carrier Direct Pay) authorization (use Form ST11P for purchases made before your MCDP was issued; use Form ST11‐PUR for purchases made after your MCDP was issued) • correctional facilities (use Form ST11P) • stair lifts, elevators and ramps for the disabled (use Form ST11P) • low-income housing projects (use Form ST11P) • other special construction contract exemptions, border city zones, etc. (use Form ST11P) • disabled veterans (use Form ST11‐VA) • taxpayers claiming a refund of tax paid in error on a sales and use tax audit (use Form ST11-AUD) Amended returns may be filed up to 3½ years from the date the return was due or one year after the order date assessing tax (i.e., on an audit). Keep all supporting documents for any amended returns in your records. These must be made available to the department if your business is audited. If we find that the amended returns were in error, you could be billed for the tax plus penalty and interest. Continued Example Stock. No. 2100950 (Rev. 3/09) You made sales to an organization in the month of May 2008, charged sales tax, and reported the tax on your monthly return. Later, the organization gave you a valid exemption certificate and requested a refund of the tax paid in error. The sales incorrectly taxed were: Month of May 2008 Gross receipts . $5,500 Original general rate taxable sales . .. 3,500 Corrected general rate taxable sales . 3,000 Original sales tax paid . 228 Filing by Internet 1. Select File an amended return. Choose the ending period for the return you are amending from the drop-down box. (If you choose “Other Period,” another screen will open. Select the ending period for the return you are amending.) Click Continue. 2. Select the reason for amending the return. Enter a contact name, phone number and explain the reason for the change in the text box. Click Continue. 3. Enter “5500” in the Gross receipts line, (there is no adjustment to this amount). 4. Enter “3000” (the corrected amount) on the General rate sales line. 5. Enter “228” (the amount of sales tax paid on the original return) on the Total payments for the tax period line. 6. Click Calculate to figure the tax. The system will automatically calculate the refund or amount due. In this example, there would be a tax refund of $33. 7. Click Continue to file the amended return. 8. Print or save the confirmation number for your records. Filing by phone 1. Press 3 to amend a return. Enter the ending period for the return being amended (May 2008). To choose a period, use two digits for the month “05” and four digits for the year “2008.” 2. Enter a two-digit reason code for amending the return (see reason codes on page 2). 3. Enter “5500” and then the pound key (#) for the gross receipts line (there is no adjustment to this amount). 4. Enter “3000” (the corrected general rate taxable sales), followed by the # key. Press 1. 5. Follow the prompts for any other tax types (e.g., local taxes) for which you may be registered. e‐File Minnesota will calculate your amended return. 6. Press 1 if the amended return is correct, press 2 to repeat the total, or press 3 to start over. 7. Write down the confirmation number and date filed for your records. 1

By publishing your document, the content will be optimally indexed by Google via AI and sorted into the right category for over 500 million ePaper readers on YUMPU.

This will ensure high visibility and many readers!

PUBLISH DOCUMENT No, I renounce more range.

You can find your publication here:

Share your interactive ePaper on all platforms and on your website with our embed function